State of the Market - September 2023

While one cannot predict the future, there are two trends occurring right now that would seem to be very important for the next five years in regard to business sales and M&A. These two trends deal specifically with supply and demand - a basic economic concept which most certainly plays into business sales and M&A.

The first trend is a movement out of corporate America. These are first time buyers looking to buy themselves a job. A recent survey of 700 buyers showed nearly half were first time buyers looking to buy themselves a job “to be more in control of their future”. These buyers are looking to replace an income, and oftentimes industry is less important than cash flow.

These buyers also usually have big retirement accounts, many of which can be tapped into via plans, such as the BORSA Plan, which enable buyers to access these funds without any penalties or taxes whatsoever. They have cash and cash equivalencies to purchase a business.

A second trend has to do with Private Equity groups. PEGS and PIGS are typically high net worth buying groups which acquire due to synergistic and strategic reasons. They have liquidity, lending connections, and do not seek to run the daily operations. Private equity deals have moved down the food chain to incorporate more and more Main Street and Lower Middle Market sized transactions. I consider Main Street deals to be those valued from $0 - $2mm. Lower Middle Market deals are those valued from $2mm - $50mm. One can subdivide each segment.

These smaller deals have become easier for PE firms to finance. There are more of them available to pursue. And with the adoption of an “add-on” strategy, PE will look at deals nearly any size. By add-on, we mean a business that would synergistically add-on to an existing bigger business and add value overall. PE groups love add-ons to their existing platforms. Usually these groups desire existing management to be in place; or for the seller to stay on and continue to run the business.

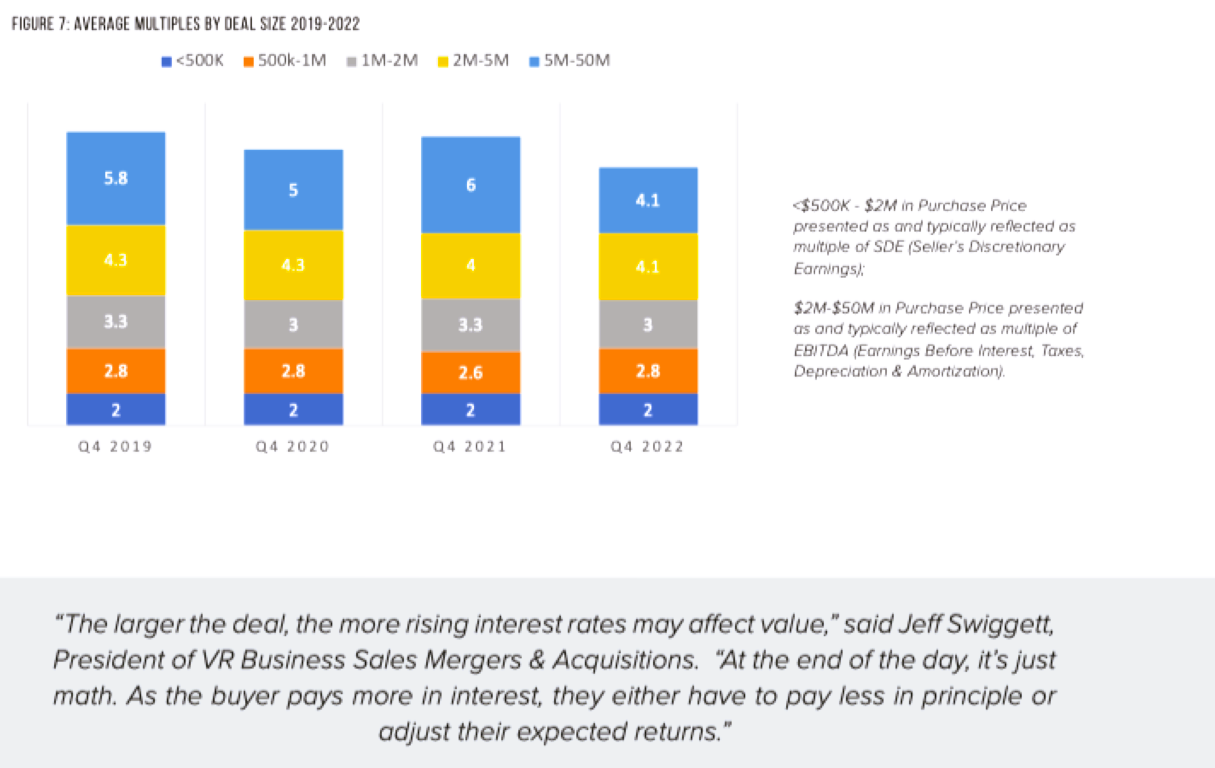

Perhaps this increased PE activity in the $5mm - $50mm range is part of the reason Median Multiples in this range have gone up

So if the buyers are there, then what are they buying. What can you do now to position yourself to capitalize on this movement?

I think you need to focus on 3 specific industries. Broadly speaking these would be: 1. VMS (Vitamins, Minerals & Supplements); 2. Manufacturing (including certain Fabrication); and 3. Construction/Construction-related. Now, E-Commerce is without a doubt one of the hottest and most profitable industries. I intentionally left that off because it is captured by VMS. E-com is profitable, but competitive and needs a solid, proven product to garner the highest valuations.

Within VMS you bring in that E-Commerce component. What is interesting about this industry is you typically encounter one of two types of companies. Either they manufacture the product, and sell to distributors, white label, etc. Or, they sell the product, which is usually done heavily via the company’s E-Commerce platform. Amazon has captured over 70% of ALL supplement sales online. E-Commerce sales represent 15% of the total Supplement Industry - indicating a lot of growth potential for online sales in this area. The unique company does both - manufacture their own product. They are out there, but hard to find it seems. We have one currently listed on the West Coast.

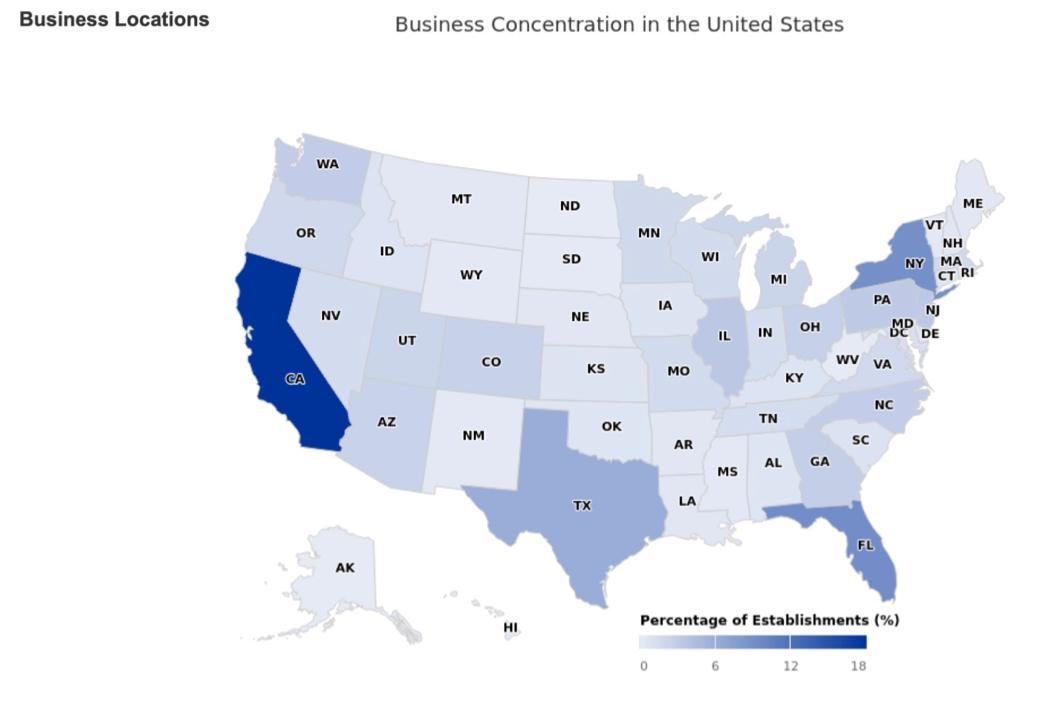

The good thing is, whether the business manufactures or just sells E-Com, the valuation multiples are very favorable, and these companies are very popular. There are certainly many, many type companies within DFW. In fact, Texas has the 2nd or 3rd most Supplement companies in the United States.

Recent transaction numbers prove VMS to be popular as well. In Q2 2023 Consumer Goods/Retail - the class VMS would fall under - was the 3rd most numerous deal closed in the <$500k, $500k - $1mm, $1mm - $2mm, and the $2mm - $5mm ranges. In the Middle Market range of $5mm - $50mm it was the second most numerous transaction. These figures indicate the popularity of this space, and VMS is the leader of this space.

The Construction industry was the single most popular industry in the $550k - $2mm, and the $5mm - $50mm range. Construction was overwhelmingly the most popular acquisition in the Middle Market $5mm - $50mm range. Manufacturing was the most popular in the $2mm - $5mm range.

According to the IBBA, in 2022 Construction and Manufacturing composed nearly 40% of all acquisitions in the Middle Market. On Main Street in 2022, nearly 1/3rd of all deals involved either Consumer Goods, Construction or Manufacturing. These are the industries to focus on. The buyers will be there, and recent history shows these are the top 3 industries.

My personal experience corresponds precisely with those figures. I currently have a Rebar Fabrication company on the market for sale which we had under contract before we even listed it. We have a VMS E-Commerce company which has attracted hundreds of buyers. I also currently have 4-5 construction-construction related listings which are drawing great numbers of inquiries.

To conclude, focus on these three industries if you are looking to acquire a business in an industry that is currently in demand, and based on historical trends will continue to remain in high demand.

- VMS (E-commerce & manufacturing)

- Construction

- Manufacturing & Fabrication: Steel fabrication, etc.

Each of those three areas can certainly be subdivided into smaller categories. For instance, VMS can be further divided into Manufacturers, E-Commerce, Brick & Mortar. There are supplies, distributors, private labelers, etc.

The same could be said of Construction. Is it new construction? Remodeling? Commercial or residential, or both? There are General Contractors and Sub-contractors. With Manufacturing there are a plethora of possibilities. In addition, Fabrication is very close to Manufacturing, though slightly different with its own set of companies and valuation metrics.

The point is these three industries are both active in business sales and M&A - and also desirable by buyers of all types. Thus whatever the vertical within one of these industries may be, there is a high probability and likelihood of find plenty of profitable opportunities, and plenty of ready, willing & able buyers.

Shep Campbell

C: (870) 450-3734

Merger & Acquisition Specialists

Share On: